This article originally appeared on the SimpleTax blog. SimpleTax has joined Wealthsimple to become Wealthsimple Tax. Now you can invest, trade, save, and do your taxes all in one place.

It’s happened to your dad, your childhood best friend, your boss, and—if you’re reading this post—it’s probably happened to you. You’ve gathered all your documents, completed your tax return, filed it through NETFILE, and are feeling pretty good about being done. But then you receive another slip, find a missing receipt, discover a typo, or simply realize that you need to make a change.

First, don’t panic. You can change your return. While you can’t resubmit your return through NETFILE, making a change isn’t hard. Let’s walk you through it.

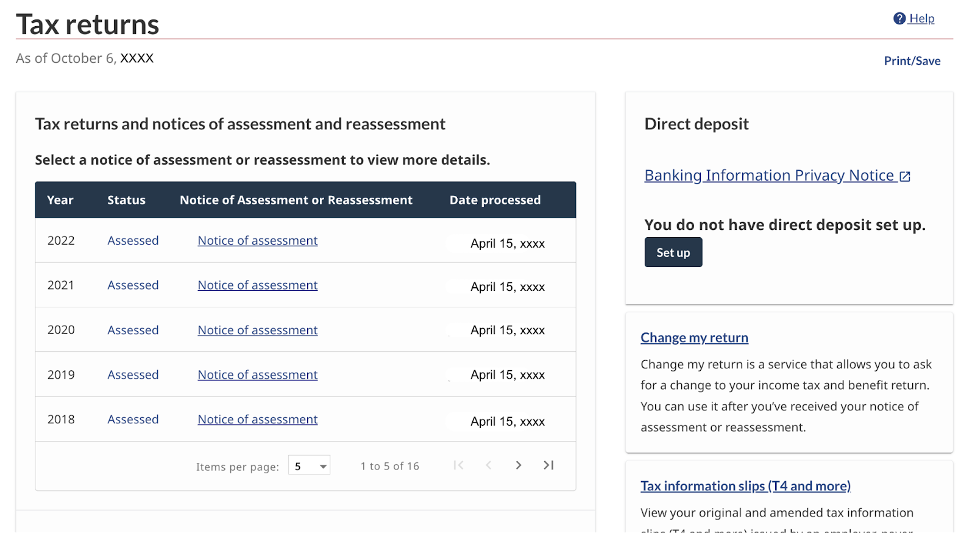

You can only change your return once it’s been assessed. This usually occurs within seven days of filing, but the Canada Revenue Agency's (CRA) service standard is to have your return assessed and Notice of Assessment within two weeks if filed through NETFILE. Note that if you didn’t use NETFILE, or if you invest in tax shelters, this can take more than longer. Using CRA My Account, you can click on the “Tax Return�” tab to see whether your return has been assessed.

How to change your tax return

Log in to Wealthsimple Tax and—if you haven’t already—save a PDF copy of your tax return using “Print return.” This file is just for your records; we won’t use it again. Follow these simple steps and you’ll be “adjusted” in no time.

Using ReFILE

ReFILE is available for Tax Year 2020 to Tax Year 2023. First, make the necessary changes to your return in Wealthsimple Tax, then Check & Optimize your return to address any errors. In the Submit section, click the ReFILE button to review your changes and submit your amended return. If your return goes through successfully, you’ll see a new confirmation number and message from the CRA.

Using CRA My Account

If you aren’t able to ReFILE, change your return online using CRA My Account. Log in to CRA My Account and click the blue Change my return link in the Tax Returns section.

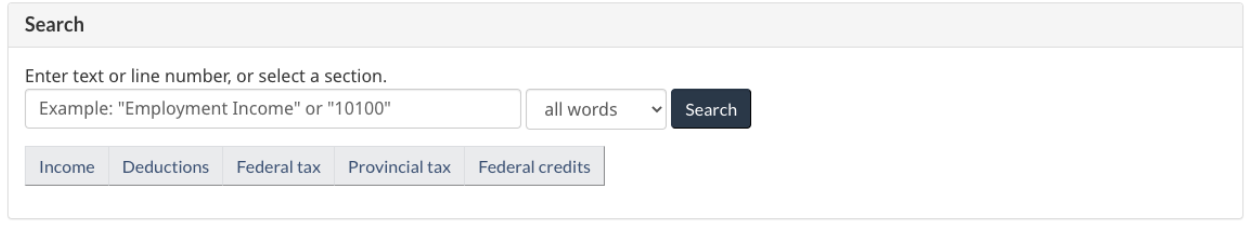

Select the year you want to change. A page like this will appear:

Use the search box to find the line numbers that have changed on your return. Enter any amounts that have changed (several fields won’t accept decimal places, only enter decimals if the field you are changing shows decimals in CRA My Account).

Make all of your changes before clicking Review and Submit Changes. The CRA will save your changes as you go. (There’s no save button, but it saves.) When you’re happy with your changes, click Submit.

When you’re ready to confirm and submit the changes, the CRA may display “errors” or “warnings.” Errors stop you from making a change until you provide additional information, while warnings give you the opportunity to add additional information that may be applicable to you.

After submitting your changes, you may have an amount owing. You can send money to the CRA through your bank, similar to how you pay bills. Simply add the CRA as a payee with your SIN as the account number. You can confirm your changes and payment by checking My Account.

On paper (T1 Adjustment Request)

If you aren’t able to use ReFILE or CRA My Account, you can file a paper T1 Adjustment Request. Simply transcribe the changes from the Show Differences box onto the T1 Adjustment Request. Mail the T1 Adjustment Request and any supporting slips or documents described on the form to your tax center (find the address on page 2).

Frequently asked questions

You can only amend your tax return after you’ve received your initial assessment from the Canada Revenue Agency (CRA). Once you have your assessment, you can file an amended return either online through your My Account online service or by submitting a completed T1 Adjustment Request Form (T1-ADJ) by mail. You’ll also need to submit any supporting documents and other required information.

You can only file your taxes once, but after you receive your Notice of Assessment (usually within seven days of filing), you can submit changes to your return in multiple ways depending on your filing status.

If you filed a T1 (individual) income tax return, you can amend it one of three ways. These are:

- Log in to your My Account and use the Change My Return option (generally the fastest method).

- Submit a completed T1 Adjustment Request Form (T1-ADJ).

- ReFILE to make adjustments to Tax Year 2020 to 2023 returns.

Before filing a return through NETFILE, confirm that the tax software in question is certified by the CRA for the tax year in question.

You can request a change to a return from one of the previous 10 tax years. For requests filed in 2024, you may only request changes to tax year 2014 and later.

When you file an amended return, the CRA will review your return and reply with one of two documents. You’ll receive either a Notice of Reassessment showing the accepted changes and recalculated tax return to take those changes into account or a letter explaining why the CRA rejected your requested changes.

Once you’ve submitted your amended return, you should expect to hear back from the CRA with either a Notice of Reassessment or an amendment rejection letter within:

- Two weeks for online adjustments

- Eight weeks for paper adjustments

The processing time can vary depending on the complexity of your request and any documents or verifications required. Situations commonly resulting in extended filing times include:

- The CRA has to contact you or your authorized representative.

- Your request involves multiple tax returns or tax years past the normal three-year reassessment period.

- Your amendment is for a bankruptcy-related return.

- The taxpayer in question is deceased.

- Your request involves a carryback amount.

- An international or non-resident client/taxpayer makes the request.

- An elected split-pension amount is involved.

You can edit your tax return online in one of two ways. These are:

- The Change My Return option found in your My Account

- ReFILE for those who filed with either NETFILE or through an EFILE service provider

File with Wealthsimple Tax. Maximum refund, guaranteed.

Get started for free