This article originally appeared on the SimpleTax blog. SimpleTax has joined Wealthsimple to become Wealthsimple Tax. Now you can invest, trade, save, and do your taxes all in one place.

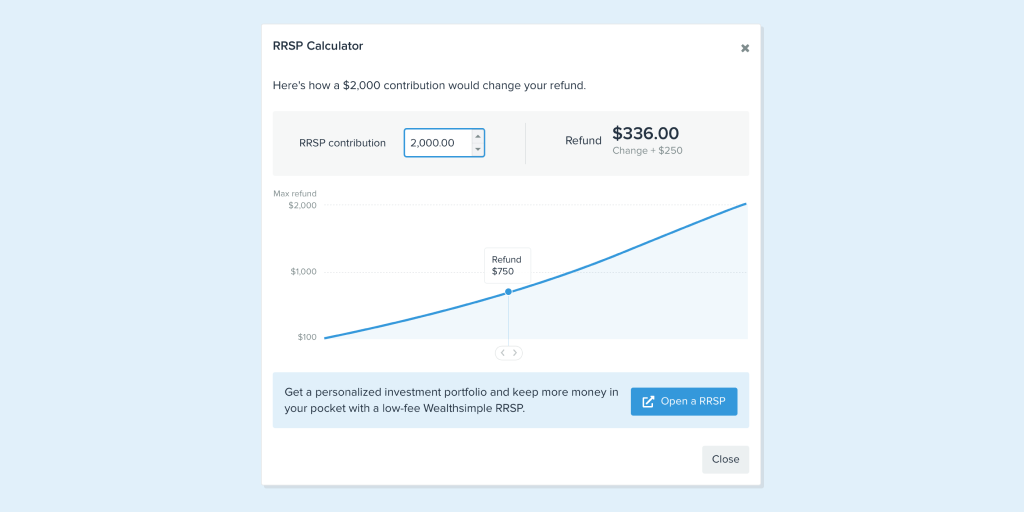

Contributing to your RRSP is not only a smart way to plan for the future, it can help grow your refund now. But how much should you contribute? Enter our redesigned RRSP calculator.

To access the RRSP calculator (which will be available in SimpleTax until the RRSP contribution deadline), go to the “RRSP Contributions & Deductions” section of SimpleTax then click the “Calculate” button. You can enter various contribution amounts and instantly see the impact on your refund or taxes owing. For the most accurate results, complete as much as your return as possible before using the calculator.

Your RRSP deduction limit is either 18% of your earned income or the amount set by the CRA — whichever is lower. Unused contribution room can be carried forward to future years. You can find your tax year 2019 RRSP deduction limit on line A of your notice of assessment or by logging into your CRA My Account. See more info here.

Open an account for your saving goals

Start investing